in just 8,000/-

Keynotes on Private Limited Registration

It takes 10 to 15 days for Private Limited Registration

Completely online service - No physical presence required.

No Minimum Share Capital required

A private limited company is a small and large type entity which is privately held by business owner. This is very important for any businessman to fulfill all legal requirements as it helps the business to be launched successfully in the competitive market. If you are an entrepreneur then you want to set- up your business without any legal issues with smoothly and properly register it then come to us. It is important to use the proper steps of private limited company registration fees in India.

Private limited companies serve various functions and play important roles in the business world. It is a popular choice among entrepreneurs small to medium-sized businesses with distinct features and benefits. Now One Click Business Solutions provide authentic accounting services of company registration. We offer reliable solutions for how to register private limited company in fastest turn-around time at affordable price.

At One Click Business Solutions Pvt Ltd get a dedicated team for private limited company registration process in India. We provide highly experience financial expert to incorporate a private limited company with proper documents submit in order to avoid any legal issue. They are committed to serve our clients in the best way and focused on helping the growing entrepreneurs who want to stand on their own.

It's important to know that the specific rule-regulations and requirements for private limited company incorporation may vary depending on the jurisdiction in which the company is registered. A basically documents are required at the time of company formation which are mention below. So what are you looking for! It is the perfect time to start your private limited company today at low cost with us.

If you are looking for private limited company formation then you’re in right place. Here find the quick process of private limited company registration at low fees and fill up all documents step by step. With the help of our professional consultant, you can get a complete Private Ltd Company Registration in Kolkata-MP-Delhi for startup business and it will take 10 to 15 days to get incorporation certificate. Find best support from our experienced experts to quickly incorporate you company from anywhere in India.

The registration procedure of private limited company is quite easy in India. Let us know the mandatory documents required for private ltd company registration and process it step by step. Find the list of documents below as a checklist when you start with your Pvt Ltd company formation process.

Passport size photograph of directors

Copy of PAN Card of directors

Photo Copy of Property papers in case of owned property

Water, Electricity or Gas bill of Business place

No Objection Certificate from landlord (format will be given)

Copy of voter identity card or aadhaar card of directors

Photo Copy of rent agreement in case of rented property

At least 2 directors are needed

Minimum 2 shareholders are needed

No Minimum Share Capital required

Minimum one designated partner should be Indian resident

Now online register a private limited company no minimum paid-up capital is required and it necessary to have pvt ltd at the end of the company name. Private Ltd Company registration can be done easily in few working days. One Click Business Solutions has been providing registration services all over India at a very affordable price.

The proposed directors and shareholders need to apply for digital signature. Digital signature is known as an online signature used for filing. DIN denotes Directors identification number allotted by Ministry of Corporate Affairs. If the directors have DSC then it is recommended to skip this step.

2 different options for your company name are to be offered to Ministry of Corporate Affairs of which one will be chosen. Names offered should be distinctive and indicative of company business.

After digital signature and name approval, we will draft all the directors' and shareholders' declarations sheets for their acceptance, articles of association, memorandum of association and subscription sheet.

Once approval of name is completed, one requires to draft Articles of Association and Memorandum of association. Both AOA and MOA are to be filed with the Ministry of Corporate Affairs with the subscription statement.

In order to create a private limited company and acquire the incorporation certificate, generally 15 to 25 days are required. Incorporation certificate shows that the company has been formed. This involves CIN number too.

You don't need to apply for PAN and TAN separately as it is automatically applied with company registration submission forms. TAN and PAN can be obtained in 7 working days. After this, the incorporation certificate, AOA, MOA and PAN can be submitted to a bank for opening a bank account.

Requirements to Start Private Limited Company in India

Find the quick Private Limited Company Registration 100% online at cheapest price with the help of professionals are trained and highly experienced CA Consultant, they process the documents step by step for private ltd company registration in Kolkata West Bengal, Burdwan, Howrah, Hooghly, North-South 24 Parganas, Nadia, Jalpaiguri, Birbhum, Murshidabad, Cooch Behar, Dinajpur, and so many more districts. We will help you to formation of Pvt Ltd company and get the license in few working days.

No Minimum Share Capital required

Few more ROC (Registrar of Companies) compliance is needed by Pvt Ltd Company during every financial period.

Maximum 200 members can be there in a Private Limited Company.

Entrepreneurs prefer private limited to facilitate potential for future growth and easy share transfer.

The name of the company is crucial. It makes first impression of the suppliers, buyers and stakeholders. It must be relevant, attractive and suggestive. Different factors are there to remember while naming a company :

The name of a company should be related to the business and its brand.

The name of the company should not be identical or same to an existing trademark or company. Try to avoid plural version, punctuation marks or spacing in an existing company name.

The name should be short and not be long. It should be pronounced and remembered easily while people read or hear it easily.

The name of the company should not violate law. It should not be against the beliefs of any religion and customs and not abusive.

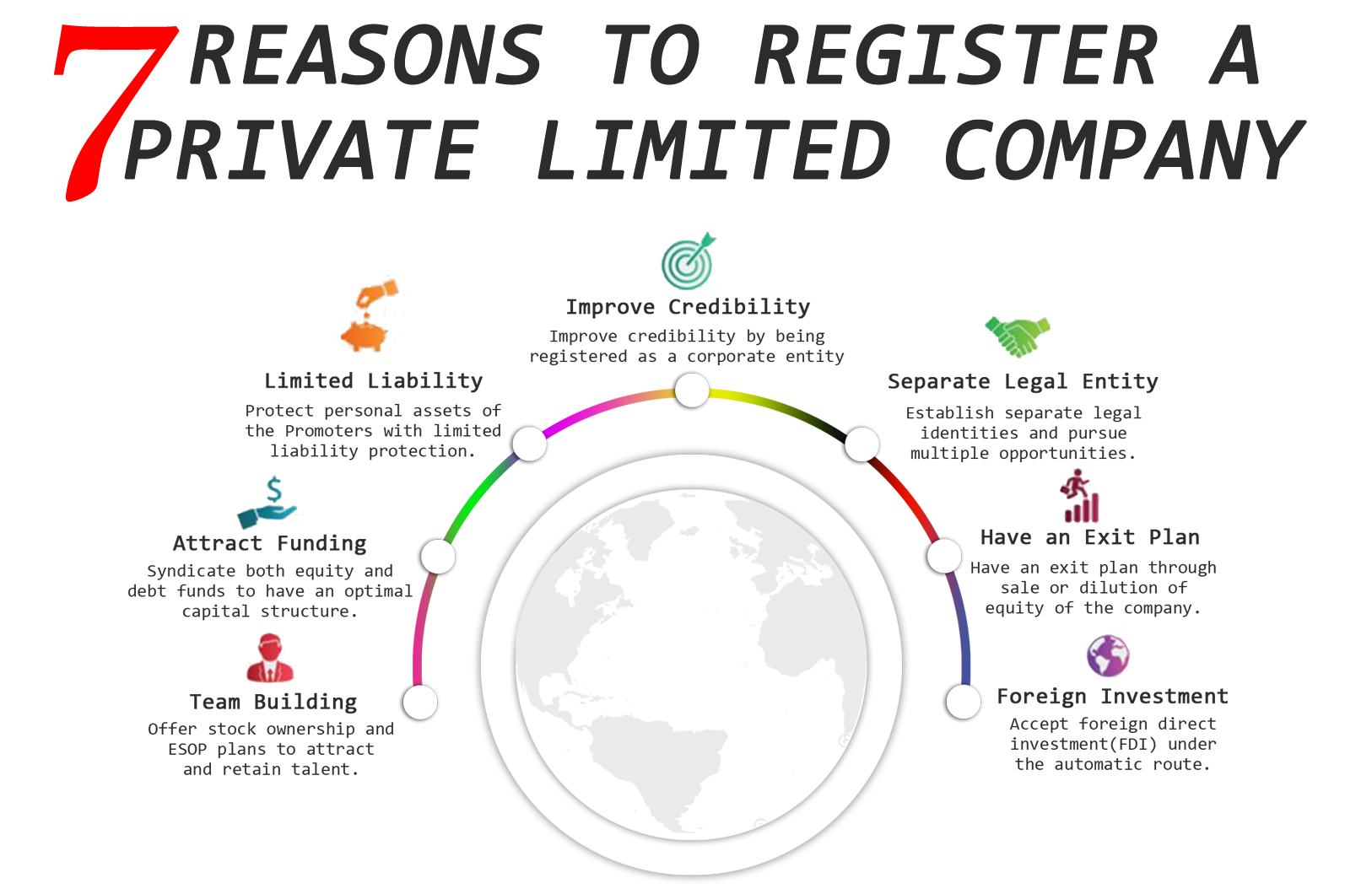

ADVANTAGES OF PRIVATE LIMITED COMPANY REGISTRATION

Easy to register, administer and continue

Preferred by investors and banks

Provides benefits of a public limited company and flexibility of a partnership business

Distinct legal entity that reduces liability

Easy to allocate and redistribute shares to other directors or investors

It can be easily dissolved or wind-up

DISADVANTAGES OF PRIVATE LIMITED COMPANY REGISTRATION

Strict Compliances

Cannot take deposits

Bank finance is not accessible before 2 years

Yearly cost of compliance

Yes, an existing business can be upgraded into a corporate identity. You can convert your existing business into the private limited company which is difficult process. Feel free to contact us for further assistance on this procedure.

We offer private limited company registration service. In India, private limited company is known as the most popular option of legal entity. Incorporation of Private limited company is accomplished under the companies Act 2013 which is managed by Ministry of Corporate Affairs (MCA).

By using our professional services, you can complete Private Company Registration. The total procedure takes 10 to 15 days to be completed. You just need to fill out a brief questionnaire.

We charge Rs 8000 approx. to accomplish the registration procedure of a private company.

Yearly maintenance cost depends on status of the private limited company in India. It may vary in various circumstances.

Yes. NRI can be a director in Private Limited Company. Although there is no need to get prior approval of the RBI or Government yet, one director should be a resident of India.

According to the amendment of Companies Act 2013, all Private Limited Companies must have a minimum paid up capital of Rs. 1 lakh.

Minimum two persons are needed to start a private limited company. This can be enhanced to a maximum of 200 individual. Besides, you may be a sole individual and want to commence a private limited company. You may opt to register One Person Company (OPC). OPC is a kind of private limited company that can be made with only one member/shareholder/director.

As soon as the private limited company is created, various documents are needed to open

bank account. Following documents are needed to open the bank account :

PAN Card acknowledgement

Certificate of Incorporation

Articles of Association (AOA)

Memorandum of Association (MOA)

Bank Account opening form according to the respective bank

Board Resolution according to the format provided by bank.

During the filing of the documents, the attorney is called by the ROC on a particular date for scrutiny. This is due to making required changes in the Articles of Association and Memorandum of Association filed. Once this is completed, the certificate of Incorporation is approved for the company.

Once the company is registered, the following should be fulfilled :

Appointment of a Statutory Auditor

Current account must be opened since when PAN registration is completed

Shares should be issued and allotted

Deposit of paid-up capital which was stated during registration

A company does not need an office space for incorporation but a proper address is compulsory. The company must have a proper setup of office then one can file application for the registration procedure. You can start your company by giving your home address during the incorporation procedure.

Unlimited company

A company limited by shares

A company limited by guarantee

If it is approved by the registrar of the company and also stated in the MoA then it can perform multiple businesses. The businesses can be in the different or same field. However, dissimilar activities like fashion designing and event management cannot be registered under the same company.

There are a couple of conditions for anybody to become a director of the Private Limited Company :

He / she needs a DIN or Director Identification Number

He / She should be 18 years or more

Minimum 2 directors are required for private limited company registration.

Yes, you can be the director of any kind of company. It is suggested to follow employment rules if that lets you to perform so.

Generally 10 to 15 business days are needed to register a company.

There is no need to hire a full-time CA or CS. At One Click, we have experienced professionals to perform all the formalities needed for annual compliance on behalf of our clients.

According to the Companies Act 2013, the name of the company should be unique and the business object should be reflected by it.

All proposed directors should provide the following :

Identity proof like Passport/ driving license / aadhaar/ any government issued ID

PAN Card for Indian nationals

Passport for foreign nationals

Address proof like utility bills

No Objection Certificate should be submitted by the proprietor of the registered office premises

The DSC is digital signature certificate, issued by certifying authority for signing the electronic documents. DIN is director identification number. DIN is allotted with Certificate of incorporation with SPICe (Simplified Proforma for Incorporating a Company Electronically) Form.

A private limited company registration certificate is issued by the registrar of the company. It is legitimate all through the life of the company.

This is possible to complete the registration procedure of a private limited company with family members and later shares can be transferred also.

Maximum limits of total turnover to get exemption from registration and payment of GST for the suppliers of products would be Rs. 40 lakhs and Rs. 20 lakhs (in the States of Manipur, Arunachal Pradesh, Mizoram, Meghalaya, Nagaland, Sikkim, Puducherry, Tripura, Telangana and Uttarakhand) with effect from 01.04.2019.

The following classes of taxpayers should get exemption from getting registration :

Suppliers of services, Having turnover up to Rs. 20 lakh, performing inter State supplies

Suppliers of services, Having turnover up to Rs. 20 lakh, performing supplies through e-commerce platforms.