in just 8,000/-

Keynotes on Private Limited Registration

It takes 10 to 15 days for Private Limited Registration

Completely online service - No physical presence required.

No Minimum Share Capital Required

A private limited company is a type of business organization in which the liability of the members is limited to the amount unpaid on their respective shares. This form of organization is popular among entrepreneurs, as it offers legal protection to its owners and allows them to raise capital easily. A wide range of organizations ought to be enlisted genuinely preceding beginning business-related tasks. Now Registration of Private Ltd Company is the right decision as startup business in Uttar Pradesh.

How To Register Private Limited Company in Uttar Pradesh (UP)?

At One Click Business Solutions you get online private company registration process at economical fess in Uttar Pradesh (UP). Our best professional experts provide the right procedure to incorporate your Private Ltd Company in Noida Lucknow in few working days without any legal problem. We have well-trained and highly experienced CA consultant who’ll take care of your Pvt Ltd Company formation process by accomplishing proper required documents.

We provide best accounting services and consultant for Private Ltd Company registration in Lucknow UP, anyone can incorporate their business organization without facing any difficulty. The professionals are devoted to serving the clients in the most effective way and make their business easy. There would be no legal hassles, no complications with documentation. Everything would be done by our side. Clients would have got two different options for Company Registration – Online, and Offline.

So what are you looking for! It is the right time to start your Pvt Ltd Company today in Uttar Pradesh with us.

We can clearly see the popularity of Private Limited Registration Process in Uttar Pradesh (UP) and more than 90% of the total company registrations go with it. Get the quick Pvt Ltd company registration online procedure & low fees in Noida, Lucknow, Kanpur, Varanasi, Ghaziabad, Agra, Allahabad, Gorakhpur, Jhansi, Moradabad with proper documents and also get Tax Compliance of Private Ltd Company. And now Indian Govt. has started providing ‘Startup’ facility for the newly incorporated Private Ltd Organizations.

Photo ID proof of all Directors and Shareholders (PAN Card / Aadhar Card / Voter ID / Driving License or Passport)

Address Proof of Directors (Bank Statement / Electricity or Telephone Bill)

Passport Size Photos of Each Directors

Office Address Proof (Telephone / Electricity or Gas Bill)

No Objection certificate from the Land Owner.

Minimum 2 Directors are essential

Minimum 2 Members are needed

No Minimum Share Capital required

Minimum 1 Director must be an Indian Citizen

Having DSC or Digital Signature Certificate is a must for both the Company Directors and members/shareholders. It’s a type of authentic online signature valid through the Digital World. There is another thing called, Directors Identification Number or DIN in short. This requirement is only for the proposed director of the Company.

To get an authentic name for your Private Limited Company, we will apply to the Registrar of Companies (ROC) web portal and utilize the online Reserve Unique Name (RUN) tool. The Company name must be unique and indicative to the company’s business nature.

After obtaining the above-mentioned DSC and DIN, we will prepare drafts of the declarations for the proposed directors and shareholders. These papers should be included with their consent and other vital info.

In this phase, we will make drafts of the Company’s Articles of Association (AOA) as well as Memorandum of Association (MOA). These two documents will work as the company constitution and charter. After finalization, we will submit them to the Ministry of Corporate Affairs along with other documents for the final incorporation process.

It’s the standard procedure to wait 15-20 days after the submission of final documents to the Ministry of Corporate Affairs. They will check and verify all documents and details. After satisfying all parameters, they will hand over your Company’s Certificate of Incorporation and CIN number too.

After your brand new Private Limited Company is incorporated, you also need to obtain PAN, TAN, Current Account from the Bank in the name of the company. But, you don’t need to worry about these things as we already have taken care of these procedures.

Minimum share capital needed Rs 100000

Few more ROC (Registrar of Companies) compliance is needed by Pvt Ltd Company during every financial period.

Maximum 200 members can be there in Private Ltd Company.

Entrepreneurs prefer private limited to facilitate potential for future growth and easy share transfer.

It’s very crucial to name the company. It establishes first impression of the providers, purchasers and partners. It should be important, appealing and intriguing. Various variables are there to recollect while naming an organization:

The name of an organization should to be identified with the business and the brand.

The name of the organization ought not to be similar or same to a current brand name or organization. Attempt to stay away from plural variant, accentuation checks or separating in a current organization name.

The name ought to be short and not be long. It must be articulated and recollected effectively while individuals peruse or hear it without any problem.

The name of the company should not disregard law. It must not be against the convictions of any religion and customs and not oppressive.

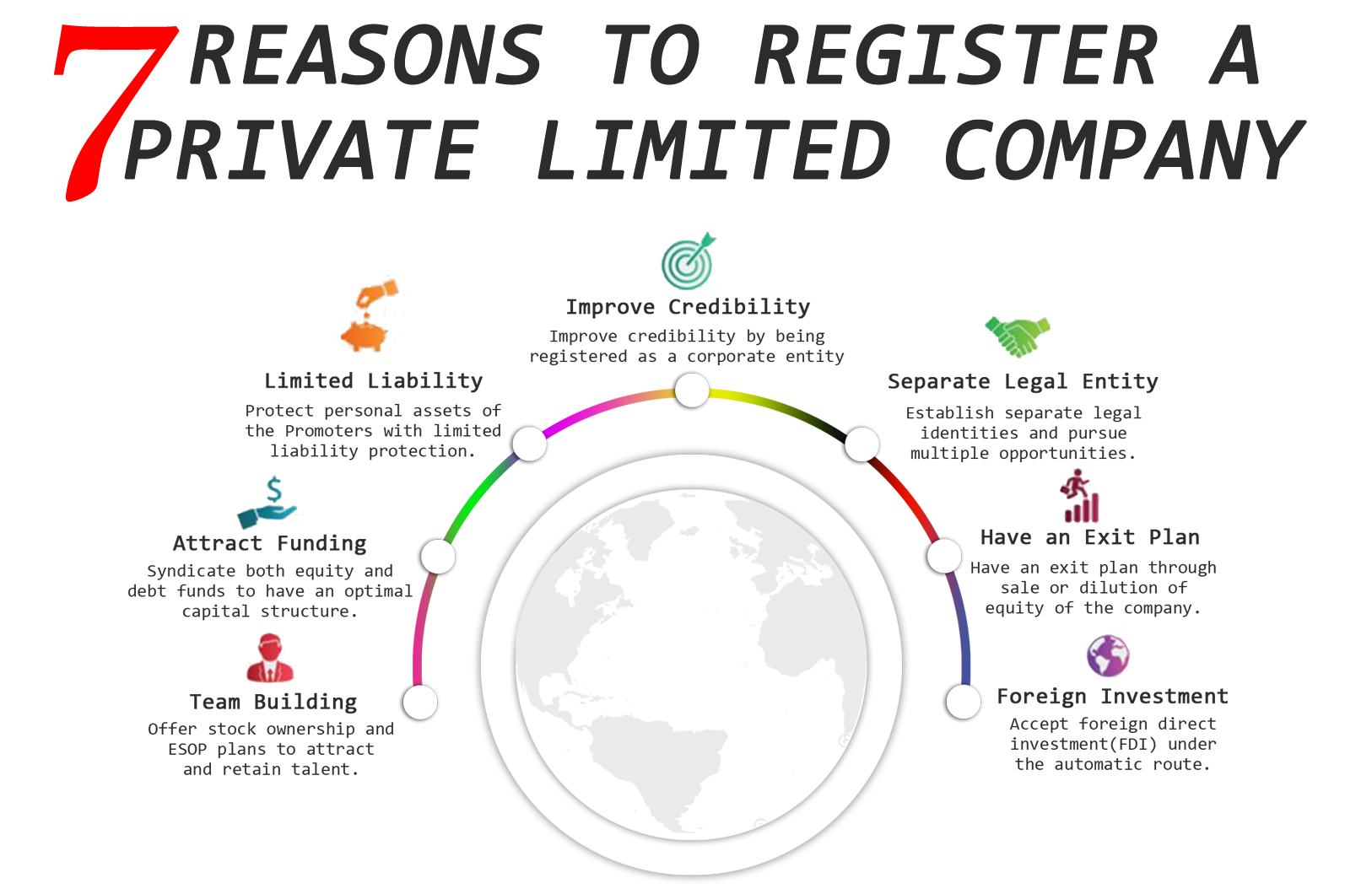

KEY BENEFITS OF PRIVATE LIMITED COMPANY

Simple to incorporate, direct and proceed.

Liked by financial backers and banks.

Gives advantages of a public limited organization and adaptability of an associated business.

Separate Legal Entity that diminishes obligation.

Simple to allot and revamp shares to different investors as well as investors.

Dissolution or winding-up the Company is quite simple.